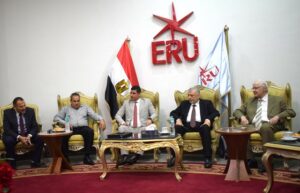

In the presence of public figures and senior officials from the Egyptian Tax Authority Egyptian Russian University Holds Seminar on “Tax Incentives and Exemptions”… Photos

Dr. Sherif Fakhry Mohamed Abdel Nabi, President of the Egyptian Russian University, announced the holding of a seminar titled “Tax Incentives and Exemptions” at the university premises to shed light on the new tax laws, tax incentives, facilitations, and how investors and business owners can benefit from the provided facilities. The event aimed to contribute to enhancing trust between the tax community and the state. It was attended by a delegation from the Egyptian Tax Authority, under the directives of Ms. Rasha Abdel Aal, Head of the Egyptian Tax Authority, as well as public figures, investors, businessmen, traders, and company owners in Badr City.

In this context, Dr. Mohamed Farouk, Director of the Entrepreneurship Club at the Egyptian Russian University, explained that the purpose of holding the seminar on “Tax Incentives and Exemptions” was to promote community engagement by the Entrepreneurship Club within its geographical surroundings to improve the financial and business environment in Badr City and neighboring cities. This was achieved through presentations by specialists and officials from the Egyptian Tax Authority to simplify tax procedures and clarify tax incentives and facilitations in order to increase trust between the Tax Authority and taxpayers.

The Director of the Entrepreneurship Club at the Egyptian Russian University added that the seminar aimed to raise awareness about reducing the financial burdens on companies, traders, and business owners—particularly small and medium-sized enterprises—if they comply with the regulations of the Tax Authority under Law No. 7 of 2025 and the amendments to the Unified Tax Procedures Law No. 206 of 2020. He pointed out that the role of the Entrepreneurship Club is to connect students with state officials to introduce them to various governmental services, thereby preparing distinguished graduates and entrepreneurs for the labor market.

Dr. Abozeid Abdel Rahman, Director of Customer Service at the Tax Authority – Large Taxpayers Center, stated that the tax facilitations represent an exceptional opportunity to settle tax positions and start a new chapter based on partnership. The Egyptian Tax Authority reminds its “partners”—the taxpayers—of the deadlines for benefiting from the first package of tax facilitations, set to end on August 12. He stressed that these facilitations pave the way for the business community to expand and grow.

The Director of Customer Service at the Large Taxpayers Center added that Law No. 5 of 2025 stipulates that no penalties will be imposed for submitting or amending tax returns and forms for the period from 2020 to 2024. It also includes the possibility of settling disputes resulting from estimated assessments for tax periods ending before 2020, in return for paying a percentage of the tax for cases assessed on an estimated basis. For bookkeeping cases, the settlement is made by paying the original tax, with a 100% waiver of late payment fines and additional taxes.

From his side, Dr. Sameh Mamdouh, Head of the Tax Guidance Center in Sharqia Governorate, emphasized that the first package of tax facilitations, launched in February 2025, is an important step toward addressing accumulated problems and settling tax disputes through clear and simplified procedures. He explained that Law No. 6 of 2025 introduced a simplified tax system for projects with an annual turnover not exceeding 20 million Egyptian pounds, with fixed tax rates based on business size and significant tax incentives and exemptions to encourage small business owners to integrate into the formal economy.

The Head of the Tax Guidance Center in Sharqia Governorate stated that the Tax Authority urges taxpayers to quickly settle their tax positions by taking advantage of the facilitation package approved under Laws No. 5, 6, and 7 of 2025, issued on February 12, 2025. He noted that each type of request has a specific deadline for benefiting, as follows: Requests to settle disputes for tax periods prior to January 1, 2020, under Law No. 5 of 2025, are available until August 12, 2025.

Dr. Sameh Mamdouh further explained that requests for tax accounting and payment of the due tax on real estate transactions or the disposal of unlisted securities in the stock exchange, carried out during the five years preceding the enforcement of Law No. 5 of 2025, are available until August 12, 2025. The submission of original or amended returns for the years 2020 to 2023 for income tax, and 2020 to 2024 for VAT, is also available until August 12, 2025.

The seminar was attended by: Dr. Ezz El-Din Abdel Aziz, Dean of the Faculty of Applied Arts; Dr. Makarem El-Ghamry, Dean of the Faculty of Al-Alsun; Dr. Said Hassan, Vice Dean of the Faculty of Artificial Intelligence; Accountant Tarek Belal, Chairman of the Board of Trustees of the Educational Administration in Badr City; and Dr. Mona Moussa, Deputy Director of the Entrepreneurship Club at the University.

It is worth noting that attendees from the Egyptian Tax Authority included: Dr. Mohamed Mohamed Wahid, Director of the Online Portal and member of the Media Center at the Office of the Head of the Egyptian Tax Authority; Accountant Hamdy El-Banna, General Manager of Badr City Tax Office; Accountant Rachad Ahmed, Head of Census at Badr City Tax Office; Accountant Ayman Idris, Head of Direct Audit Committee at Badr City Tax Office; Accountant Sayed Mohamed, Census Department at Badr City Tax Office; Accountant Bahaa Ahmed, Census Department at Badr City Tax Office; Accountant Islam, Obour City Tax Office; Accountant Noora, Obour City Tax Office; and Radwa, Obour City Tax Office.